Enjoying the latest news of the stock market decline? Yeah, we’re not either.

Also, if this article is too long, here’s the summary (the “TLDR”):

- Market jitters are about uncertainty.

Markets like predictability. Right now, things like tariffs (or any big economic/political event) are causing companies to second-guess their costs, pricing, and hiring—which trickles down to stock prices moving up or down. - Volatility is normal.

Short-term drops—even 15–20%—happen regularly and are part of investing. Bigger drops (25–30%+) are rarer and usually tied to major events but often followed by strong recoveries. - Your emotions matter.

Behavioral finance shows that fear and overconfidence can lead to poor decisions like panic selling. Understanding these tendencies helps you stay grounded during market swings. - History is on your side.

The market has consistently recovered over time. Diversification (like ETFs and mutual funds) lowers risk significantly compared to individual stocks. Patience pays off—especially after big dips. - What you can do:

- Keep short-term money in safer places.

- Know what you own and why.

- Don’t panic—sometimes doing nothing is the best move.

- A good financial plan is your best defense.

Okay, so let’s cut to the chase.

What’s going on with the markets?

First of all, markets are like people, they like certainty, which we don’t have a lot of right now. There is not a lot of clarity of what the long-term effects of these tariffs will be, or if they will stay - and that causes markets to go all over the place.

For example, if a company is going to have a large increase in costs due to a tariff, they made need to increase their prices to the consumer (you & me), and we may decide we don’t need to buy those bon-bons after all. Which then means that company is then not going to make any money from you, which means they will reduce their profits, which means their stock price will fall.

So, it goes like this typically (in both directions, up & down): changes happen to world/taxation/legislation (such as a pandemic, housing crisis, or tariffs), a company tries to estimate how to adapt (raise prices, hire/fire staff) and a stock price goes up or down in anticipation of this change.

Okay, enough behind the scenes, let’s talk about how you feel and how frequently these things happen.

How you feel

Market volatility doesn’t just test portfolios—it tests patience. And often, our emotional reactions pose a greater risk to long-term success than the market itself. Behavioral finance helps explain why. It looks at how cognitive biases and emotional responses can cloud our judgment and lead to decisions that don’t align with our long-term goals.

Take loss aversion, for example—the tendency to feel the sting of losses more acutely than the satisfaction of gains. In practice, this can lead investors to sell in a panic during downturns, turning a temporary paper loss into a permanent one.

Overconfidence bias is another culprit, where investors overestimate their ability to predict market movements, often resulting in under-diversification or outsized risk.

And then there’s herd mentality—following the crowd instead of the plan. We saw it during the dot-com bubble, when enthusiasm overtook fundamentals, and again during other speculative surges. In those moments, it’s easy to lose sight of what’s most important: your unique financial goals and time horizon.

Ultimately, understanding these psychological tendencies is the first step in managing them. A disciplined, intentional approach to investing—anchored in a well-crafted financial plan—can help you weather the emotional ups and downs that come with every market cycle.

How frequently do these things (stock market declines) happen?

Much of this was adapted from Cory Mitchell’s post, thank you Cory!

Market declines happen more often than we think—but that doesn’t mean they’re always cause for alarm. A 15–20% drop in the S&P 500 is relatively normal and tends to occur once or twice every five years. These aren’t anomalies—they’re part of the natural rhythm of a long-term investment journey.

Even the larger drops—25%, 30%, or more—while unsettling, are infrequent. A 25% decline might occur once a decade or so, and 30%+ drops have only happened a handful of times since the 1950s. These larger downturns often mark the end of a cycle and the beginning of a new one.

Recoveries do happen—and they’re often powerful. After the 1974 crash, the market rallied nearly 2,500%. Following the back-to-back declines in 2000 and 2008, the S&P 500 has climbed over 700% (not including dividends). Long-term investors who stayed the course were rewarded.

Big headlines don’t always mean lasting damage. Some of the worst declines—like those during the dot-com bust, the financial crisis, or COVID—led to the disappearance of poorly positioned companies (think Pets.com, Lehman Brothers, and Hertz). But they also set the stage for long-term growth in stronger, more resilient businesses.

Perspective and planning matter. Short-term volatility is part of the deal when investing in equities. What matters most is having a plan that reflects your time horizon and temperament. Are you the type to stay invested through the storm—or do you need clearer markers for when to step in or out?

Markets are emotional machines in the short term but rational over the long haul. With a thoughtful strategy, consistent contributions, and an understanding of history, we can navigate downturns with confidence instead of fear.

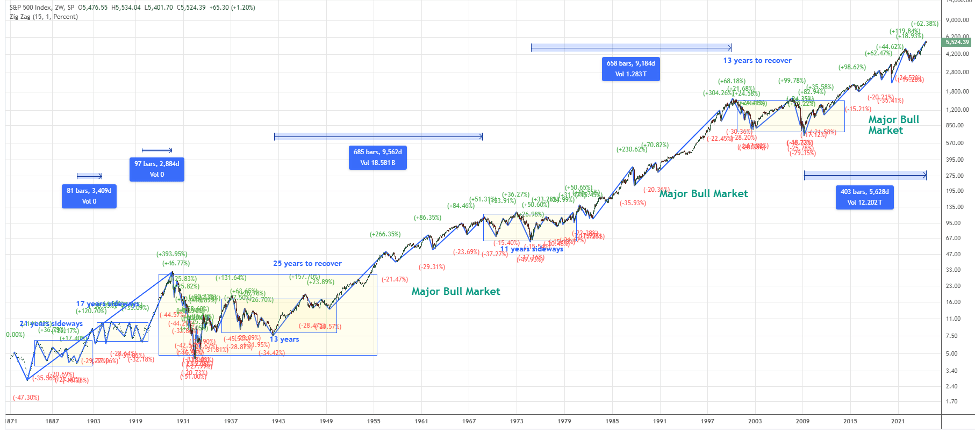

For those who like charts, this chart shows all the 15% drops (following at least a 15% rally) going back to the late 1800s. Click on any chart to see an expanded version of it.

Here’s an easier-to-read growth chart of the market, credited to Morningstar investment research. Long-term investors have weathered declines in the market.

Good news

The market historically has always come back to those who have patience. Now, certain businesses have gone under (remember Chuck E Cheese, anyone?), but investors like yourselves, can avoid taking unnecessary risk by owning investments that are diversified, so as low-cost Exchanged Traded Funds (“ETF’s”) and mutual funds that own shares in thousands of companies instead of individual companies.

When you own an individual stock in a company, there is a risk that your investment will go to zero. When you own a diversified investment there is also a chance of that, but it is greatly reduced since to have that happen all of the companies in that investment would need to go bankrupt. The likelihood of that is pretty low. If every company in your ETF went bankrupt, your biggest problem wouldn’t be your 401(k)—it’d be whether you have enough canned goods to last the apocalypse.

So where are we going with this? Oh right, the good news. In the past, when the US consumer has felt the worst (“low sentiment”) the forward 12-month returns of the market have been positive; historically a 24.1% return after the sentiment trough (low), which is the time that investors are feeling the worst. Now, this is not always the case, but this can help give some emotional buffer in these situations. See the chart below.

Other good news is, the market is up the majority of the time. However, like that old saying goes, what goes up, must come down (sort of). When we look at the history of the S&P 500 index back to 1980, it has had a positive year-end return 76% of the time.

What can you do?

First, this is where good financial planning comes in. Any money you’re going to need in the next couple of years should be in low-risk investments that can weather storms like we’re seeing now.

Second, know what you own. If you’re not sure, talk to your advisor (or us, if we’re not them yet!). Knowing why you own what you do can provide a lot of peace of mind.

Third, take a breath. Know this is uncomfortable for the reasons we talked about in “How you feel” above. Though it seems counterintuitive, sometimes not changing anything can be the best course of action.

Hope you are doing as well as you can, and please let us know what we can do to help you through these turbulent times.

All the best,

Laura Corbiani & the Astraea Team

Investment advisory services offered through Equita Financial Network, Inc. an Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Equita Financial Network also markets investment advisory services under the name, Astraea Wealth Management LLC. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this blog is for information purposes only. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Securities investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.